On a regular basis, we analyse a current property-related issue with significant stakes. Today, the President of the APCAV, Brigitte Borel, talks to us about the Real estate gains tax. Enjoy your reading!

On the sale of a building or land that is part of private wealth, a special tax is due: the tax on real estate gains. The actual amount of tax to be paid when selling your property will essentially depend on cantonal tax law, generally the length of ownership and sometimes the amount of the capital gain.

The tax will only be due to the extent that a profit is made, i.e. if the sale price is higher than the cost price. The latter is in principle made up of the acquisition price plus the investments borne directly that have generated a capital gain during the holding period, called expenses (see p.28 of the brochure “Tax on real estate gains” cf. source below).

Sometimes, the purchase value cannot be established precisely when it comes to a building held for many years. Special provisions then intervene to determine the acquisition price, which differs according to the cantons. In Valais, failing that, “the cadastral value on January 1, 1977, can be invoked as the purchase price” (p.30 “Tax on real estate gains”).

Costs deductible from the real estate gain

Regarding expenses, these are expenses that lead to an increase in the value of the property during the period of detention, such as:

- Construction costs

- Enlargements

- Conversions

- Lasting improvements

- Land improvements

These expenses are not comparable to expenses related to the upkeep of the property and the maintenance of its value, which are deductible from ordinary income in the same way as mortgage interest is in the year in which they are incurred (exceptions for demolition for replacement construction as well as for energy saving costs, the negative balance of which not yet deducted can be carried over to the following two tax periods).

The costs related to the purchase during the acquisition and sale of the property are also deductible from the real estate gain. They include notary fees, registration fees in the land register, brokerage commissions (capped), costs related to advertisements, lawyers’ fees or transfer duties paid. They also include the indemnities paid in the event of early termination of your mortgage during the sale. The furniture included in the sale price, the value of which is indicated in the deed of sale, can also be deducted from the real estate gain. However, all these expenses must be able to be justified.

Co-owners, spouses and children are taxed separately on their real estate gains.

We therefore advise you to keep carefully throughout the duration of possession of the property all the invoices and proof of payment of the costs that you will be able to deduct from the real estate gain at the time of the sale to determine the amount of the payment.

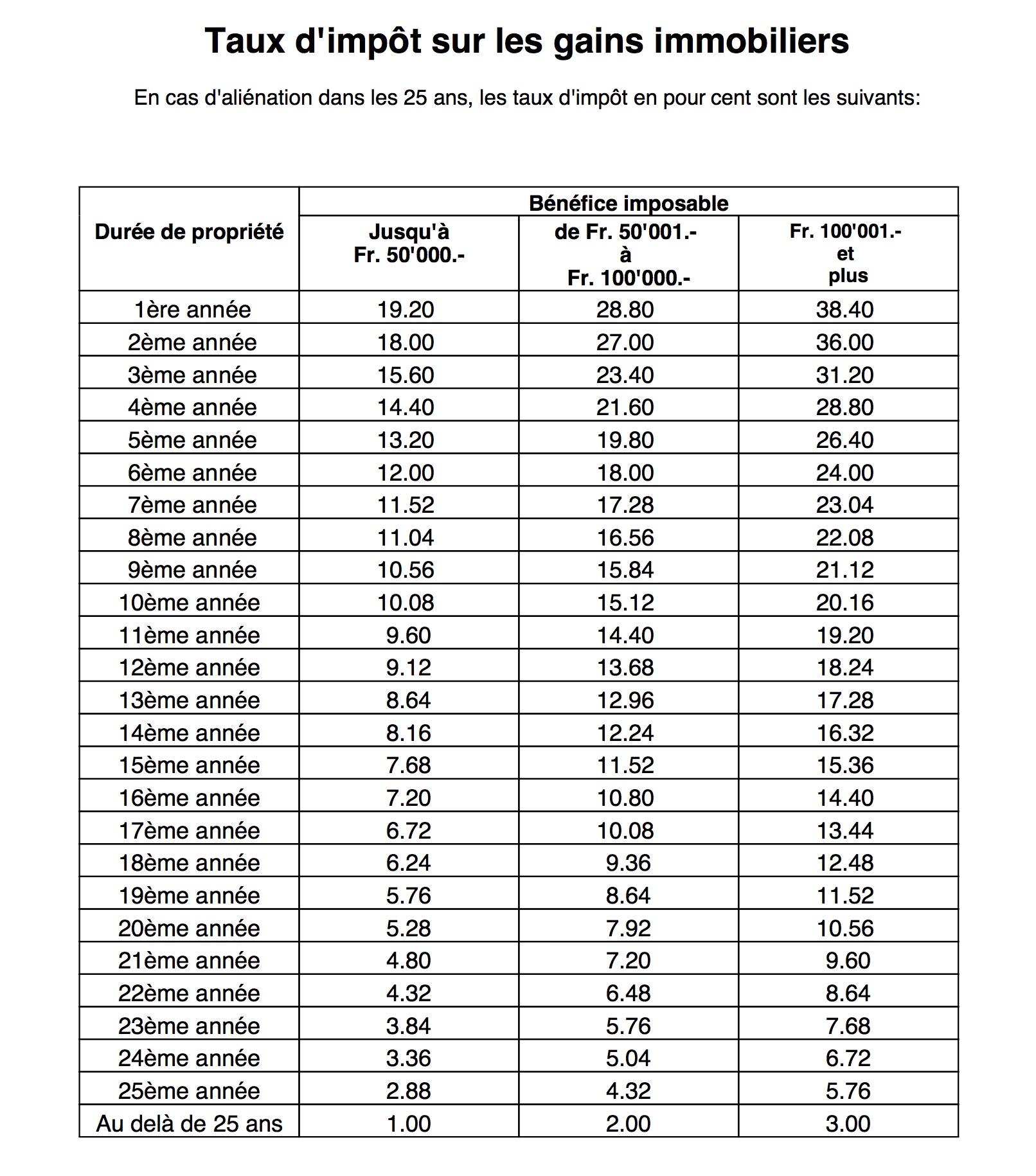

Real estate gains tax is calculated on the amount of the gain. Its rate decreases as the years of ownership, the floor rate being reached from 25 years.

Situation in Valais

Note that foreigners who are not domiciled in Switzerland can only sell their property after 5 years of ownership.

Reinvestment of sale proceeds and deferral of real estate gains tax

Real estate gains tax is not always due immediately. In certain circumstances, it may be postponed. This is the case if a new building of the same use and of the same nature is purchased within a reasonable time after the sale (Valais maximum 2 years), if a so-called replacement purchase is made. This deferral can only apply if the property sold had been used as a principal residence for at least two years and if the new property acquired as a replacement is also purchased and lived in by the same owner. This therefore does not apply to second homes or rented objects. The tax is only deferred for the part of the real estate gain that is invested in the replacement property, provided that the price of the replacement property is higher than the sale price of the initial property.

The deferral of taxation means that no real estate gains tax (or only a part of this tax) is levied when the property is sold. This is not a tax exemption. In the event of subsequent resale, both the capital gain generated by the replacement building between its purchase and its disposal and that generated by the replaced building will be taxed, unless there is a new reason for postponing the tax.

In the event of resale following reinvestment, the acquisition price is equivalent to the investment expenses of the replacement building minus the gains for which the tax has been deferred. This reduction in capital expenditure ensures the post-taxation of previously untaxed real estate gains.

If the purchase price of the new property is lower than the investment expenditure of the old one, only a partial postponement is possible. The difference between the sale proceeds and the reinvested amount will be taxed immediately. This will be the case if a detached house is sold for age-related reasons in order to buy a smaller and cheaper apartment.

Example of reinvestment

| Scénario 1 : Prix du bien de remplacement est supérieur au prix de vente du bien initial | Scénario 2 : Prix du bien de remplacement inférieur au coût d’investissement du bien initial | Scénario 2bis : Prix du bien de remplacement inférieur au coût d’investissement du bien initial | |

| Prix de vente | CHF 2’000’000 | CHF 2’000’000 | CHF 2’000’000 |

| Coût d’investissement | CHF 1’400’000 | CHF 1’400’000 | CHF 1’400’000 |

| Gain immobilier | CHF 600’000 | CHF 600’000 | CHF 600’000 |

| Prix d’achat du bien de remplacement | CHF 2’400’000 | CHF 1’600’000 | CHF 1’200’000 |

| Gain immédiatement imposable | CHF 0 | CHF 400’000 | CHF 600’000 |

| Report de l’impôt possible sur | CHF 300’000 | CHF 200’000 | CHF 0 |

A change of ownership within a family, for example in connection with a divorce, can also give rise to a deferral of real estate gains tax. The same applies in the event of inheritance, donation, or advancement of inheritance. In these cases, too, the payment of the tax is only postponed. The advantage, however, is that it is the duration of possession of the previous owner that will be considered.

Conclusion

Many deductions are possible to reduce the amount of taxes to be paid on the real estate gain realized in the event of the sale of real estate. It is important to be aware of the possible deductions to keep the receipts as and when the expenses are made. This can save you a lot of work at the time of the sale as well as optimize your tax situation.

We also advise you, before signing a deed of sale, to seek advice from your trustee or a tax expert so that all the elements of your specific situation can be considered.

Sources:

- Tax on real estate gains (March 2022), Swiss Tax Conference. Document to download here: d-besteuerung-grundstueckgewinne (003).pdf

- Declaration form for property gains in Valais) Microsoft Word – Déclaration IGI_FR_version online.docx (vs.ch)

- Tax on real estate gains: the sale of a house is taxable | Credit Suisse (credit-suisse.com) Impôt sur les gains immobiliers: la vente d’une maison est imposable | Credit Suisse (credit-suisse.com)

- Acquisition of the replacement home – when is real estate gains tax due? Acquisition du logement de remplacement – quand l’impôt sur les gains immobiliers est-il exigible? | VZ Vermögenszentrum (vermoegenszentrum.ch)

- PV114062-1_KSV_Liegenschaften_UG_fr_GzD.pdf (vs.ch).