In a series of short and focused articles, we will try to bring you a better understanding of the Swiss tax system. They will be broken down to these topics.

We will follow up this series with a small cocktail event to allow you to pose your own questions.

- Tax system – Federal, Canton, Municipal, etc.

- Domiciliation – Permits and duties, taxation, lump sum deductions.

- Real Estate Tax – when purchased, when used, when sold/donated/deceased

- Deductions – Real estate expenses – if rented, if renovated, if converted, energy savings

Louis Tornay, qualified tax expert, founder and director of Swiss Tax Services SA, Place Centrale 10, 1936 Verbier answers our questions.

A. How does the Swiss tax system work?

Before defining how much tax will be due, it is necessary to know to whom it will be paid. The question of tax domicile is therefore the first important issue to be defined. A resident in Verbier versus a non-resident owner of a chalet or apartment in Verbier will not have the same tax obligations, its taxability being different.

Otherwise, Switzerland is characterized by its federalist system with 3 levels (and with 27 different tax laws): the Swiss Confederation (Federal), the Canton of Valais and the Commune of Val de Bagnes, in our context. Knowing that there are periodic taxes, which recur every year, and that others are unique or linked to specific situations, here is the summary table.

Note that while income tax is levied at all levels, there is no wealth tax or inheritance tax at the Swiss level within the Canton of Valais. In this respect, each canton is sovereign.

B. What are the main taxes levied, and by whom?

|

Periodic Taxes |

Municipal (Commune) |

Canton |

Confédération (Fédération) |

|

| Income tax | X | X | X | |

| Wealth tax | X | X | ||

| Property tax | X | |||

| Non-periodic taxes | ||||

| Inheritance tax | X | |||

| Capital gains | X | |||

C. How does the tax calendar work?

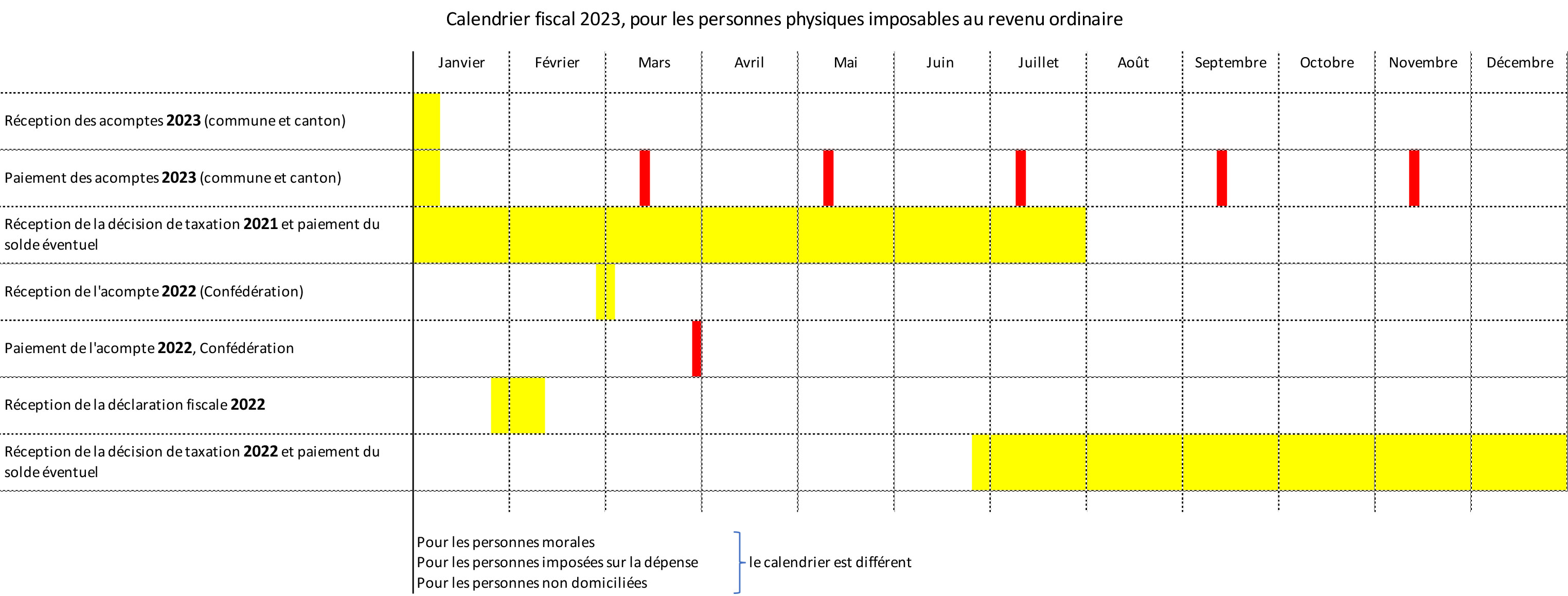

In terms of the timetable, it is also complex. As we approach the year 2023, the calendar could look like this:

- January 2023: Advance payments for the municipality and the canton for 2023

- January 2023: Receipt of the tax return to be completed for the period 2022 (January to December)

- February 2023: Advance payment to the Confederation for 2022

- Spring 2023: Receipt of the 2021 tax decision and the 2021 balances to be paid

It is not necessarily easy to find your way around, as the tax periods may be intermingled between the instalments, the balances to be paid and the forms to be filled in.

You have a broader view in the attached table.

D. What are the two decisive elements for determining the tax?

To determine the tax, two elements are essential: the taxable base and the tax rate that applies to it.

For the three levels mentioned above, the tax rate is progressive and reaches a maximum of 35.5% for income in Verbier and 0.6% for wealth. Except in special cases, all income is added up (dividend, salary, pension, …), before general and social deductions.

Although Switzerland enjoys a considerable and appreciated stability, the tax system can evolve. For example, in 2023 the Valais parliament should consider a revision of the tax law which could reduce – but slightly – the wealth tax.

At the level, the question arises as to how to tax a couple: as an economic unit, as at present? Or individually for all?

Otherwise, the taxation of the rental value is also under consideration, but already for many years…